does new hampshire have sales tax on cars

The state derives its constitutional authority to tax from Article 5 Part Two of the state constitution. There are however several specific taxes levied on particular services or products.

2002 Bmw 3 Series 325xi For Sale In Plymouth New Hampshire Listedbuy In 2020 Bmw 3 Series Plymouth New Hampshire

Tax policy can vary from state to state.

. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. New Hampshire is one of the five states in the USA that have no state sales tax. Property taxes that vary by town Auto registration fees A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption.

States like Montana New Hampshire Oregon and Delaware do not have any car sales tax. No sales tax No capital gains tax No inheritance or estate taxes New Hampshire does collect. Washington DC the nations capital does not charge sales tax on cars either.

Consumer Protection Bureau Office of the Attorney General 33. What confuses people is the property tax on cars based upon their book value. Therefore all residents of New Hampshire will not have to pay vehicle taxes.

So if you live in Massachusetts a state that has sales tax but buy a car in New Hampshire a state with no sales tax you will still have to pay tax to your home state of Massachusetts when you go to get your license plates. New Hampshire is one of the few states with no statewide sales tax. Car Sales Tax for Trade-Ins in New Hampshire Trade-ins can help lower the cost of purchasing a new vehicle.

New hampshire does not charge sales tax on vehicles. Do you have to pay sales tax if you buy a car in New Hampshire. New Hampshire Delaware Montana Oregon and Alaska.

Unlike standard excise taxes however the end consumer must pay the tax directly to the New Hampshire Department of Transportation and receive documentation registration and title papers proving the fees were paid. New hampshire does not have state or local sales tax or any sales tax laws. You pay it every year and it declines to around 200 but thats it.

Exact tax amount may vary for different items. 1-888-468-4454 or 603 271-3641. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it.

States With No Sales Tax on Cars These five states do not charge sales tax on cars that are registered there. How do I get a sales and use tax exemption certificate. 2022 New Hampshire state sales tax.

New Hampshire does collect. 18 first year 15 next lowering to 03 in year 6 and beyond. However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New.

Shop Great Deals and Read Detailed Reviews - Find a Used Car in New Hampshire. However it does not have local sales tax. Alaska Delaware Montana New Hampshire and Oregon do not.

You pay it every year and it declines to around 200 but thats it. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125.

There is no sales tax on anything in NH. Ad Cars Trucks and SUVs. We use cookies to give you the best possible experience on our website.

New Hampshire is one of the few states with no statewide sales tax. New Hampshire collects a registration fee and a title fee on the sale or transfer of cars and motorcycles which are essentially renamed excise taxes. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Montana Alaska Delaware Oregon and New Hampshire. According to the Tax Foundation the average taxpayer will pay just over 1000 per year in sales taxIn the 2020. Does New Hampshire have a sales tax.

This means that no city has higher or lower car tax rates. New Hampshire generates the bulk of its tax revenue by levying select sales taxes otherwise known as excise taxes and a corporate income tax. Unfortunately unless you register the car in the sales-tax-free state you will still have to pay the sales tax when you register the vehicle with your home states DMV.

So assuming you buy a 60K vehicle the taxes registration fees look like this. My neighbours who collect very expensive cars 1M do not. Some other states offer the opportunity to buy a vehicle without paying sales tax.

New Hampshire does not have sales tax on vehicle purchases. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055. While states like North Carolina and Hawaii have lower sales tax rates below 5.

A 9 tax is also assessed on motor vehicle rentals. No there is no general sales tax on goods purchased in New Hampshire. In fact the state is one of five states that do not have a sales tax.

Sales tax is a large revenue driver for 45 states and the District of Columbia. Does New Hampshire chage a sales tax when buying a used car. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety.

Any New Hampshire business contacted by a state or locality regarding the collection of sales or use tax is also encouraged to contact the DOJs Consumer Protection Bureau. Does New Hampshire have excise tax. Traveling out of state to buy a used vehicle will not save you from paying state sales tax.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Does New Hampshire have property tax on cars. New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle.

Based on the NH numbers you basically pay a reducing of original sales price annually. What states have the highest sales tax on new cars. - Answered by a verified Tax Professional.

For more information on motor vehicle fees please contact the NH Department of Safety. Only five states do not have statewide sales taxes. Map and driving directions.

All of New Hampshire is tax-free for vehicle sales. The Department has no authority to issue a certificate. If you purchase a vehicle in new hampshire but register it in another state.

If you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car. As of 2019 our research has found that five states have 0000 sales tax. Property taxes that vary by town.

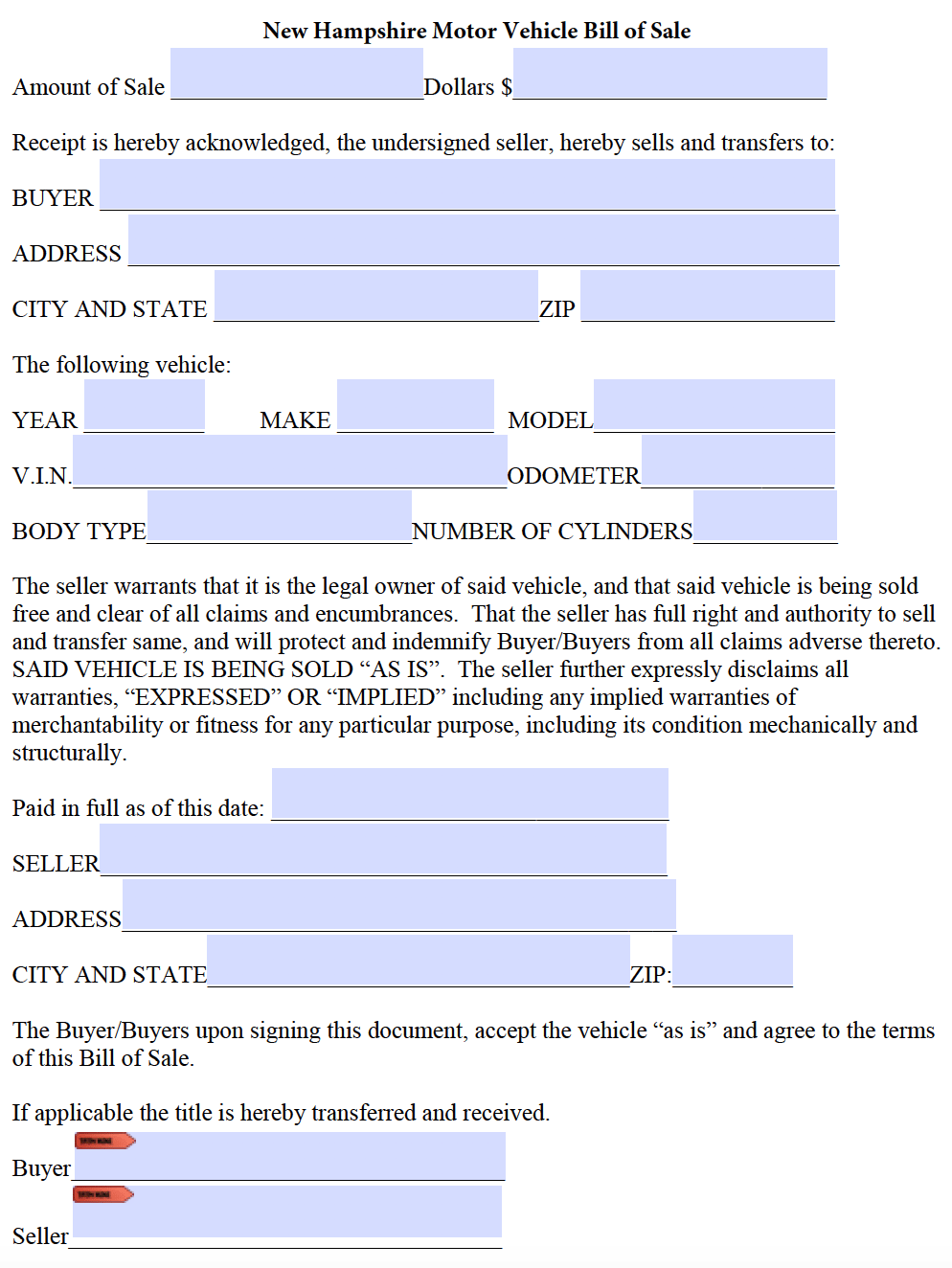

Free New Hampshire Bill Of Sale Forms Pdf

Register A Car In New Hampshire Maine Massachusetts

What S The Car Sales Tax In Each State Find The Best Car Price

Dozens Of Cars Pileup In New Hampshire Just Over Massachusetts Border As Roads Turned Into An Ice Rink Christmas Morning

1948 Mercury Woody Wagonfor Sale Listing Id Cc 874519 Classiccars Com Driveyourdream Mercury Woody Wagon Wagons For Sale Wagon

1982 Audi 5000s Diesel Audi Audi Cars Audi 200

Vintage Stuff Adverts Austin The Austin Vintage

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Why Choose Enclosed Auto Transport Transportation Vehicle Shipping Transport Companies

Vw My Life Wolkswagen Fusquinha Fusca Azul

Nj Car Sales Tax Everything You Need To Know

1966 Bond Minicar 250 G Estate Kgf Classic Cars Flickr Classic Cars Old Cars Bond

Pin By Daniel Chiras On U S Ems Fire Patrol Vehicles Police Cars Police Truck Police Car Lights

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Fakturera Utan Foretag Smidig Och Enkel Tjanst Starta Blogg Foretag Blogg Entreprenor

How To Sell A Car In New Hampshire The Dmv Rules For Sellers